Search Results

for Nick Cunningham | @nickcunningham1 - The Fuse

EV Sales Skyrocketing, But Not Fast Enough

Some of the largest automakers unveiled a slew of new commitments and spending plans to scale up their electric vehicle lineups at the start of the year.

U.S. Becomes Largest LNG Exporter. Why that May Mean Costlier Gas at Home

The U.S. recently jumped into the top spot as the world’s largest exporter of liquefied natural gas, overtaking Qatar and Australia.

Oil Market Heading for Surplus

The emergence of the Omicron variant in late November ended the year-long oil price rally, but analysts are still trying to gauge the full impact.

Biden Abandons Plans to Curtail Drilling on Federal Lands

The oil and gas industry has tried to pin extreme market volatility on the clean energy transition and higher prices on government policies restricting fossil fuel production

IEA Sees Renewables Overtaking Fossil Fuels and Nuclear by 2026

A record volume of renewable energy is expected to come online in 2021, with 290 gigawatts of new capacity. That surpasses 2020’s record, when renewables accounted for all of the new electricity capacity installed worldwide.

Biden Taps SPR, But Remains at the Mercy of OPEC+

The U.S. government announced that it would release oil from the strategic petroleum reserve in coordination with a handful of other countries in an effort to tame oil prices.

IEA: Oil Price “Reprieve” On The Way

After months of oil prices steadily climbing amid a tightening market, the worldwide rally may soon take a breather.

Russia’s Role in Europe’s Gas Crisis

Natural gas prices have spiked worldwide, with price surges most acutely felt in Europe.

Biden Can’t Fix Short-Term Energy Prices, But Can Accelerate Transition

The global spike in commodity prices has resulted in expensive gasoline, which is always a political headache for whichever political party is in power.

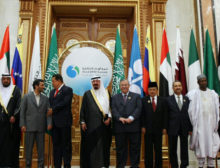

Global Leaders Want More OPEC+ Oil and More Climate Action

OPEC+ will meet in the coming days to decide on next steps in regards to unwinding extraordinary production cuts. Meanwhile, in Glasgow, global leaders are trying to ratchet up the climate ambition.

Saudi Arabia Says it is Aiming for Net Zero Emissions. How Serious is it?

Ahead of COP26, one of the world’s largest oil producers committed to reaching net-zero emissions by 2060.

Will the U.S. Go to Glasgow Empty-Handed?

The stakes are high as President Biden nears COP26 with an ambitious U.S. climate change program hanging in the balance.

New Gas-Fired Power Plants Should Be Cancelled

A new report has found that any new natural gas plant proposed today will be unable to recover its initial investment.

The Campaign to Limit Fossil Fuel Supplies

With COP26 rapidly approaching, there is growing momentum to speed up the energy transition.

China’s Energy Crisis Comes as World Urges Faster Climate Action

Stark mismatches in demand and supply have hit China's power sector as the international community urges a swift shift from fossil fuels.

Methane Crisis Needs Urgent Action

Slashing methane emissions from the oil and gas industry is one best and most urgent areas of climate action, according to a new report from the International Energy Agency.

Oil Hits New High as OPEC+ Refrains From Larger Production Increase

Modest OPEC+ production increases push oil prices toward their highest in seven years - and can climb further as investors stay away from the industry.

Oil Market Tightens, Pushing Up Prices

After the energy crunch caused natural gas, coal and metals prices to spike, analysts believe oil will be next.

Ford’s Big Bet on EVs

Ford announces the largest investment in its 118-year history with a decisive jump into electric vehicles.

China To End Overseas Coal

While still building coal power plants at home, China has announced that it will no longer fund the construction of coal plants abroad.

The High-Stakes Budget Bill in Congress Could Turbo-Charge the Energy Transition

The vast $3.5 trillion reconciliation bill, sprawling legislation aimed at improving the quality of life for Americans is also a big-time energy and climate bill.

Climate Crisis Influences Multiple Elections in Europe and North America

Climate change has emerged as a front-and-center issue in multiple elections across the world.

Major Oil Companies Need To Wind Down Oil Production or Face Stranded Asset Risk

As the world stays on track with climate targets, oil and gas companies must begin to consider the fate of new and upcoming projects.

Natural Gas Prices Soar Worldwide in a Mark of Extreme Volatility

A perfect storm of supply and demand issues have sent LNG prices soaring.

As Climate Crises Multiply, U.S. Infrastructure Inundated By Disaster

A series of successive climate disasters has exposed U.S. infrastructure as entirely unfit for the 21st century as storms, drought, wildfire and floods grow increasingly destructive.

Hurricane Ida Devastates Louisiana

More than 1 million people were left without power, and key U.S. oil and gas infrastructure was shut down, as Hurricane Ida tore through Louisiana.

Risk of Saudi Oil Policy Shift Could Rise in 2022

As peak demand becomes more obvious and decline sets in, the major producers of OPEC+ could see their incentives shift and potentially set off a scramble for market share.

The World’s Central Banks Doing Very Little to Head off Climate Disaster

As the climate crisis continues, attention has turned to how central banks can intervene.

Feedback Loops To Accelerate Energy Transition

Multiple feedback loops are emerging that a new report anticipates will push fossil fuels out of the global energy system.

The Oil Industry’s Methane Polluters

In its damning climate report, the Intergovernmental Panel on Climate Change singled out methane as a particularly damaging source of global climate pollution.

White House Struggles to Square Climate Goals and Gasoline Prices

The White House wants to slash greenhouse gas emissions in half by 2030. But asking the OPEC+ cartel to pump more oil seems to undercut those aspirations.

IPCC: Climate Disasters Will Get Worse Unless Emissions Are Cut

The bombshell IPCC report urges swift, far-reaching changes to the world's energy supply as a matter of urgency.

Nearing Completion, Nord Stream 2 Saga Approaches Final Act

A U.S.-German agreement on the Nord Stream 2 pipeline has seemingly put to bed a geopolitical saga that has dragged for more than half a decade.

Delta Drags Down Oil, But Lack of New Supply Keeps Prices From Crashing

Oil prices have sunk as concerns grow about the Delta variant.

EVs Make Progress, But A Massive Public Policy Push Is Needed

Caught between fossil fuels and electrification, automakers find themselves at a crossroads. Public policy can guide them the right way.

Japan’s Decision to Cut LNG Demand Clouds Gas Outlook

Japan plans to halve its LNG consumption – disrupting the plans of LNG exporters worldwide.

Will Shale Drillers Return to Old Ways?

While U.S. shale has recovered from a brutal 2020, it remains to be seen how long it will stick to its "capital discipline" mantra.

Europe Announces Sweeping Climate Plan

This week EU unveiled arguably the most ambitious suite of climate policies globally. But several questions must be answered before these proposals can become law.

IEA: Gas Demand is Growing. That’s a Climate Problem

Natural gas consumption is expected to bounce back after a tough 2020 – at a time when governments are looking to reduce their reliance on fossil fuels.

No-Deal From OPEC+. But Analysts Say Stalemate is “Unsustainable”

The turmoil at the OPEC+ meeting injects uncertainty into the market—and may presage the challenges ahead.

Canada Announces Plans to Phase Out ICE Vehicles by 2035

The Canadian government announced a landmark new regulation that would ban gasoline and diesel vehicle sales by 2035, adding its name to the list of governments phasing out the internal combustion engine.

Heat Dome Wreaks Havoc, Previews Future of Climate Disaster

The heatwave in the Pacific Northwest stretched power grids, squeezed energy supplies, melted infrastructure—and illustrated how far behind the U.S. is in preparing for the effects of the climate crisis.

EV Outlook “Brighter Than Ever,” But Long Way to Go For Climate

EV adoption is growing, but the window for achieving net-zero emissions in the road transport sector by 2050 is closing quickly.

IEA: Global Clean Energy Investment is Too Low

Clean energy spending must rise from $150 billion in 2020 to $1 trillion annually by 2030 for emerging economies to reach net-zero emissions by mid-century.

Rich Countries Subsidizing “Dash for Gas” in Developing World

Rich countries are using public financing to expand the construction of natural gas infrastructure in poorer countries around the world.

Biden Suspends Leases in ANWR, But Supports Other Arctic Drilling

ANWR leases have been suspended by the Biden administration, but new production will move forward in the NPR-A.

Oil Prices Hit Highest Level Since 2019 as OPEC+ Regains Control

As Brent crosses $70, oil market narratives have flipped to questions over supply rather than demand.

Disorderly Transition Likely With G20 Behind on Climate Commitments

The world's major economies will need to yank the handbrake on emissions if they are to meet their climate goals, a new report warns.

Shell Loses Court Case, Exxon Loses Board Fight in Stunning Rebuke For Big Oil

In a stunning blow to a company not used to losing, activist investors have claimed two seats on the board of ExxonMobil.

Ford’s Electric F-150 Could Accelerate Electrification

Ford unveiled the electric version of its bestselling F-150 - the biggest statement of EV intent yet among U.S. automakers.

IEA Says No New Oil And Gas Projects Needed in Call for Phaseout

In a bombshell report, the International Energy Agency states that the world must stop new fossil fuel projects immediately to hit net-zero emissions by 2050.

Rapid Renewable Energy Growth is the “New Normal”

The International Energy Agency believes the explosive growth in renewables, with installations soaring in 2020, is here to stay.

Commodity Prices Surge, Raising Odds of “Super-Cycle”

Electrification and the wider energy transition has spurred an upsurge in commodity prices.

IEA: Shortage of Critical Minerals Could Delay Energy Transition

The IEA warns that the current supply of critical minerals will not be enough to meet the energy transition demand.

California Becomes First to Try to Wind Down Oil Production

Although relatively modest in scope, California Governor Gavin Newsom's plan to phase out oil production in the state is groundbreaking in political significance.

As EV Costs Decline, Policy Aims to Accelerate Transition

As battery and EV costs decline, governments at the state and national level are eyeing a phase out of the internal combustion engine.

Biden Takes No Action on Dakota Access. The Story is Not Over.

The administration declined to make a decision on the Dakota Access pipeline in an appearance in federal court on April 9, but the court could instead take action.

U.S. Shale Steps Up Drilling, But Production Rebound Uncertain

Drilling returns to the shale patch as oil prices rise, but it remains to be seen if this activity will result in production.

Flaring in Permian Back to Pre-Pandemic Levels Even as Pressure for Action Mounts

U.S. oil production remains far below pre-pandemic levels, but methane emissions from the Permian basin are back at pre-Covid highs.

Financial Regulators Step Up Oversight of Climate Risk

Recent SEC opposition to oil and gas company sahreholder requests could be the start of a new era of climate regulation by federal financial regulators.

Fossil Fuel Investments Badly Trailed Renewables Over Past Decade

The gap between renewable and fossil fuel investments is closing, as the post-Paris Agreement performance of those fossil fuel investments falters.

Decarbonization Poses a “Political Risk Nightmare” for Oil-Dependent Countries

Oil-producing countries face severe financial and political risk as the world transitions away from oil.

$3 Trillion Infrastructure Bill to be a Major Climate Push

After passing the $1.9 trillion Covid-19 rescue package, the Biden administration appears ready to go big again with its infrastructure legislation.

IEA: Gasoline Demand Peaked, But Not Crude Oil Demand

The accelerating EV transition and fuel efficiency improvements mean gasoline consumption may never return to pre-pandemic levels.

Nord Stream 2 Nearing Completion As U.S. Weighs Last Minute Options

The Biden administration does not appear willing to kill Nord Stream 2, prioritizing other transatlantic objectives.

U.S. Offshore Wind Inches Forward After Biden Admin Gives Green Light to First Major Project

The Biden administration's endorsement of the Vineyard Wind project might jump start the American wind energy sector.

Will Higher Oil Prices Lead to a Return of Reckless Shale Growth?

As oil prices rise, the shale industry assures investors it has learned its lessons.

Fossil Fuel Hubs Have Big Potential For Renewables

The clean energy transition need not come at the expense of oil and gas workers.

Energy Transition and the Risk to the Oil Industry

Financial markets have already started to factor in the prospect of peak oil demand.

Oil Prices Rise, OPEC+ Faces Decision

As oil prices jump to 13-month highs, OPEC+ has opportunity to unwind its deep production cuts.

Scars From Texas Energy Crisis Could Linger

Millions of Texans are surely thankful that the immediate electricity crisis appears to be over. But the aftermath from the disaster will be felt for much longer.

IEA: India The Largest Source of Energy Demand Growth For Next Two Decades

Over the next two decades, India will account for 25 percent of the world’s total demand growth, by far the most of any country.

Texas Grid Crippled by Cold, Permian Production Also Slammed

The brutal cold snap in Texas overwhelmed the state's ill-prepared electricity grid, severely impacting energy production.

Oil-Producing Countries Could See Trillions in Revenue Losses From Energy Transition

Petrostates remain ill-prepared for the global energy transition, and could see a budgetary gap of $9 trillion over the next two decades.

Change In Washington, But Iran and Venezuela Still Stuck Under Sanctions

Iranian and Venezuelan hopes of a swift loosening of sanctions under the Biden administration are fading fast.

Natural Gas Prices Edge Higher on Weak Production, Shrinking Inventories

A cold snap has pushed up natural gas prices, but analysts thing slightly higher prices are here to stay.

Despite Years of Red Ink, Shale Companies Itching to Grow Again

As oil prices creep up, drillers' instincts for aggressive growth will clash with investor calls for restraint.

U.S. Set to Tighten Methane Rules as International Pressure Grows

The oil industry is now supporting U.S. federal methane regulations amid rising pressure from environmental groups, but also from investors and shareholders.

Georgia Elections Open Up Possibility for Energy and Climate Action

The results of the Georgia senate election upend the outlook for President-elect Biden, opening up a long list of opportunities on energy and climate-related issues.

Record Price Surge for LNG, Ending Market Bust

LNG prices in northeast Asia are up more than 80 percent in just two weeks, capping off a wild bust-to-boom swing in a little over six months.

U.S. Shale Activity Picks Up Even As Problems Remain

As continued OPEC curbs alongside a further hefty Saudi cut nudge WTI back above $50 per barrel, U.S. shale drillers have pulled back from the abyss.

The Last-Ditch Effort to Block Nord Stream 2

Despite the latest sanctions on Nord Stream 2, Russia has vowed to complete the project.

Most Significant Energy Bill In Years Lands In Washington

The end-of-year omnibus bill contains the first major energy legislation in more than a decade.

EU Ratchets Up Clean Energy Goals

The EU's latest climate goals will have a profound effect on energy markets.

Appalachian Shale Drillers Still Losing Despite Spending Cuts

Despite cuts to drilling and spending, the U.S. natural gas slump continues—particularly in Appalachia.

OPEC+ Agrees to Ease Cuts Slightly

Amid internal discord and budget pressures, OPEC+ has reportedly agreed to incremental production increases and monthly monitoring.

Report: Structural Bull Market For Commodities Coming

Underinvestment, fiscal stimulus and a weaker dollar could form the foundation for a commodity super-cycle.

Last Minute Push for Alaska’s ANWR Won’t Stave Off Decline

Alaska’s oil industry faces an uncertain future with poor economics, a shrinking pool of capital, and the prospect of tightening environmental policy.

OPEC+ May Be Forced to Delay Easing Production Cuts

The latest COVID-19 wave could force the group to extend the cuts once again.

U.S. Shale Industry Sees Bankruptcies and Consolidation

Low oil prices and high-profile deals point to a shift toward consolidation in the U.S. oil industry.

IEA: Pandemic Upends Energy Markets, But Faster Clean Energy Transition Needed

The IEAs latest World Energy Outlook predicts renewable energy will outcompete fossil fuels for new power generation—but more aggressive policies are needed to speed the pace of the energy transition.

What’s At Stake For Oil and Gas In 2020 Election

The outcome of the election will have significant implications for the energy industry – but some trends are beyond White House control.

Energy Transition Picks Up Steam

China's plans to achieve net-zero carbon emissions by 2060 is the latest high-profile development in the shift away from fossil fuels.

OPEC+ Faces Difficult Decisions as Market Fails to Tighten

Even after historic cuts, lower demand means the oil market is still under pressure.

BP Joins Peak Demand Crowd

BP believes evolving policy, technological advances and COVID-19 mean peak oil demand will be reached in the 2020s—or has already happened.

Oil Downturn Rocks State Budgets

U.S. state governments dependent on oil and gas revenues face a fiscal crunch as COVID-19 hits production.

Shale Faces Both Financial and Operational Problems

The oil market is close to rebalancing, and one big factor has been the steep decline in U.S. shale production.

Return of OPEC+ Oil Comes as Demand Falters

OPEC+ is ramping up production just as the demand outlook has begun to deteriorate.

Oil Majors Hit By Major Write-Downs

Behind the billions of dollars in write-downs is a substantially gloomier assumption about the long-term trajectory of the oil market.

Problems for the Bakken Begin to Mount

The Dakota Access pipeline shutdown could remove 570,000 barrels per day of takeaway capacity from the Bakken shale formation.

Shale May Not Recover From Pandemic

With global demand perhaps permanently scarred from the pandemic, the U.S. oil industry may have already peaked.

Twin Defeats Highlight Industry in Crisis

Two high-profile pipeline setbacks are part of a broader story in which the winds facing the oil and gas industry are blowing in an increasingly unfavorable direction.

U.S. Shale Succumbs to Debt

A tighter market could help shale bounce back, but the heady days of aggressive growth-at-all-costs drilling are long gone.

Oil Analysts See Stabilization and Higher Prices. But Risks Remain

A growing number of analysts argue that the worst is over for oil, but demand remains substantially lower.

IEA: EVs to Gain More Market Share

While EV sales have taken a hit during the pandemic, analysts believe it will not derail the march toward electrification.

OPEC+ Nears Extension, But Task Doesn’t Get Any Easier In Months Ahead

Oil prices have risen ahead of the next OPEC+ meeting, but OPEC-Russian coordination is far from assured.

Have We Reached Peak Shale?

A growing number of analysts believe that U.S. production will never again hit recent highs.

Unrest Brewing in Oil Producing Countries

Coronavirus and collapsing oil prices have hollowed out budgets of oil-producing countries, raising fears of instability.

Oil Shut Ins Grow. Some Supply Won’t Come Back

Oil prices are starting to climb, but supply shut ins mean the pain is not yet over.

Shale Bankruptcies to Accelerate

The demise of Chesapeake is a fitting bookend to the latest chapter of U.S. shale.

Oil Goes Negative. What Does it Mean?

The negative prices are an anomaly, related to the expiring contract in May. But the meltdown also reflects a ruinously oversupplied oil market.

OPEC+ Reaches Historic Agreement, Still Falls Short

OPEC+ agreed to the largest cuts in history, but oil prices barely moved in response.

OPEC+ Tries For Global Deal, But Glut is Still Too Large

A major production cut of 10 million barrels per day would be historic in size - and probably fail to move the needle.

Canada Faces Oil Shut Ins As Prices Drop Below $5

With a barrel of Canadian oil now cheaper than a pint of beer, producers have begun to shut in production.

Texas Explores Return of Rationed Oil Production

The crisis affecting the U.S. oil industry has reached the point where some drillers are now requesting the Texas state government step in to regulate production

OPEC and Russia Start Price War

Amid a price war, a global pandemic and shrinking oil demand, there is little hope for oil to rebound in the short term.

Will OPEC+ Cut Again? Will It Be Enough?

As the coronavirus continues to hit oil demand, pressure has grown on OPEC+ to respond.

OPEC+ Meets To Decide Cuts In Response to Coronavirus

With oil prices plummeting amid China's coronavirus outbreak, OPEC+ plans drastic action to head off an oil market meltdown

Shale Slams on Brakes As Financial Stress Deepens

Amid weaker demand and chronic oversupply, U.S. shale is facing fundamental questions about its longevity.

Libyan Oil Goes Offline. The Impact Depends on Duration

This latest outage represents a dangerous new phase for Libya, even as global markets have largely shrugged off the disruption.

EastMed Gas Aggravates Regional Tensions

While the gas reserves in the Eastern Mediterranean have helped cooperation between Israel and Egypt, they have led to more conflict with Turkey and its neighbors.

Oil Sinks As U.S. and Iran Step Back from Brink of War

The supply risk is far from over despite de-escalating Iran-U.S. tensions, but the price retreat reflects a world still awash in oil.

2020 a Crucial Year for EVs

2020 is predicted to be a breakout year for electric vehicles globally—but a contracting auto market and uncertain policy support show obstacles remain.

Nord Stream 2 Nears Finish Line, Despite Last-Ditch U.S. Effort to Sanction It

American officials concede its latest sanction efforts may not be enough to halt completion of the Nord Stream 2 gas pipeline.

OPEC+’s Balancing Act Could Get Help From Struggling Shale

If U.S. shale does not live up to market expectations, the oil market could tighten up by more than anticipated.

Shale Forecasts Run the Gamut

Talk of a global oil glut in 2020 is predicated on supply growth in U.S. shale—but predictions of shale's increases vary wildly.

Long Distance Pipeline Connects Russian Gas to China

The Power of Siberia pipeline connects Russian gas to Chinese consumers—redrawing the energy map in the process.

Offshore Oil Faces Uncertain Future

Even in the medium-term, the interest in offshore drilling is looking shaky.

OPEC's Perennial Rebalancing Act

OPEC+ might have to extend its cuts when the group meets next month, but the pain in the U.S. shale industry may make its long-term task easier.

Shale Growth Faltering As Financial Problems Mount

Chesapeake Energy's financial woes suggest the shale revolution is running on fumes.

In the Face of Risks and Questions, Saudi Aramco Presses Forward with IPO

After multiple delays, Saudi Aramco is moving forward with its IPO - but questions surround the listing amid persistent low oil prices, Saudi political issues, and fallout from the Abqaiq attack.

Oil Sands Industry Sees Setback In Canada’s Election Results

Canadian Prime Minister Justin Trudeau's election victory could create more challenges for an energy industry already struggling with low prices and pipeline bottlenecks.

Natural Gas Glut Drags Down Prices

Amid record production and swelling stockpiles, natural gas prices have sunk this year.

Despite Weak Prices, Oil Supply Outages Remain High

Global supply outages stand at exceptionally high levels—even as Brent struggles to stay above $60 per barrel.

After Abqaiq, Major Questions About Security of Supply

After the Abqaiq attacks, some analysts believe the market is overlooking rising geopolitical risk.

Abqaiq Attack Highlights Oil Risk

The oil market’s vulnerability and dependence not just on a single country, but on a single facility, was laid bare on September 14.

Supply Surplus Puts OPEC+ in a Bind

OPEC has few choices at its disposal to manage the swelling oil market surplus, most of which are unpalatable.

Tanker Seizures and Supply Risk Fails To Move Oil Market

With global oil supply outpacing demand, oil traders are shrugging off rising tensions around the Strait of Hormuz.

Venezuela Faces More Outages As Trump Admin Mulls Escalation

As the Trump administration weighs its geopolitical priorities, the future of Venezuela's oil sector hangs in the balance.

OPEC+ Extends Cuts For 9 Months, But Risks Remain

While the result from Vienna is ostensibly a success, there are obvious cracks in OPEC’s cohesion, as well as in its strategy to tighten up the market.

U.S-Iran Tension Still Simmers, But Oil Market Well-Supplied

Against the backdrop of rising tension in the Persian Gulf, OPEC+ will meet to decide next steps

Economic Concerns Take Pressure Off OPEC+ Action

The members of the OPEC+ coalition have different economic incentives. Most member countries are producing as much as they can and have little scope for higher output, so they are on board with an extension of production cuts.

Geopolitical Risk Rises For Oil

A series of apparent attacks on oil infrastructure in the Arabian Peninsula thrusted geopolitical risk to the forefront of market concerns. Against a backdrop of an already tightening supply-demand balance, the possibility of a serious supply outage poses a major risk to market stability.

Supply Risks Mount Even as Oil Market Sees Balance

Between Iran, Libya and Venezuela, the seeds of a major disruption to the oil market have already been sown. A significant outage in one could push the market into deficit.

Oil Prices Rise as U.S. Allows Iran Waivers to Expire

The U.S. State Department announced on April 22 that it would let all Iran sanctions waivers expire at the beginning of May as part of the Trump administration’s “maximum pressure” campaign on Iran.

U.S. Mulls Iran Sanctions, Constrained By Oil Market

With the expiration of the waivers now just a little more than two weeks away, the oil market is on edge as the White House weighs its next steps.

Libyan Civil War Threatens Oil Supply

The attack on Libya’s capital by a militia called the Libyan National Army threatens to cut off, or at least disrupt, the nation’s oil supply.

Line 3 Delay Another Headache For Canada’s Oil Industry

Already struggling with a lack of pipeline capacity, Canada’s oil industry hit yet another setback with the recent announcement from Enbridge of delays to its Line 3 replacement project.

U.S. Policy On Iran Constrained By Venezuela

The U.S. government's goal to knock Iran oil exports down to zero may be boxed in by its own policy towards Venezuela.

OPEC Cuts Output, Erasing Most of Surplus

While there is a long list of potential factors that could surprise the market in 2019, OPEC+ supply curbs create a tightening baseline that should lead to higher oil prices as the year wears on.

Eastern Med Gas: A Source of Excitement, And Tension

The Eastern Mediterranean has already become a significant source of natural gas production, but fully developing the region’s gas reserves, as well as finding ways to move that gas to market, has been extremely challenging.

Analysts See OPEC+ Supply Cuts Balancing the Market in 2019

Despite a range of uncertainties looming over the oil market this year, there is a growing sense that OPEC+ might be able to succeed in balancing the market after all.

Subscribe